Vendor Take Back Mortgage Benefits & Risks

$ 22.00 · 4.8 (670) · In stock

A vendor take-back mortgage is when a seller lends money to a buyer to purchase their home. This might be because the buyer was denied a mortgage or approved for a smaller mortgage.

Wraparound Mortgages: A Unique Approach to Financing Your Dream

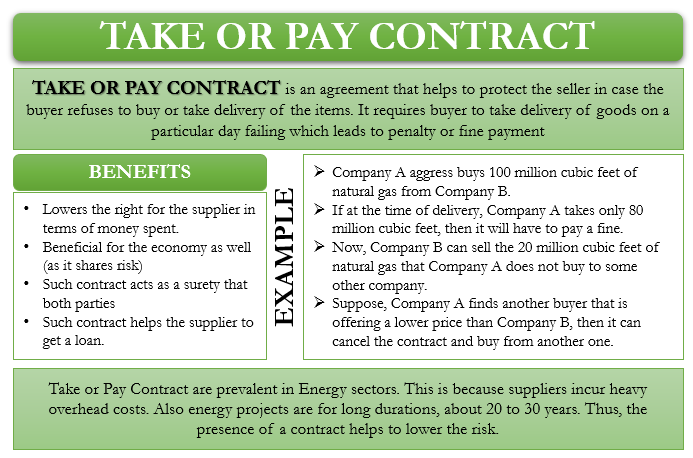

Take or Pay Contract – Meaning, Benefits, Example and More

Maximize Profit: The Benefits of Accepting a Cash Offer on Your House

Podcast 31: Pros and Cons of a VTB Mortgage and how to structure

:max_bytes(150000):strip_icc()/buying-subject-to-an-existing-loan-1798423-27ea8f47081b44c7b2ba85a2326595e2.jpg)

How Subject-To Loans Work in Real Estate

Benefits of taking Business loans: Things you should know

Ali Nassimi (@anassimi) / X

:max_bytes(150000):strip_icc()/fallout-risk.asp-Final-a06095262456473f8a18f528de82d19e.png)

Fallout Risk: What It Means, How It Works

Seller Carryback Financing in California - Alex Matevosian

What Is A Vendor Take Back Mortgage And Its Pros and Cons?

Holding a Mortgage: Definition, Pros, and Cons