On-The-Run Treasuries: Definition and How They're Traded

$ 24.99 · 4.9 (331) · In stock

:max_bytes(150000):strip_icc()/off_the_run_curve.asp-final-940493b303464d11af5d930e42a2d457.png)

On-the-run treasuries are the most recently issued U.S. Treasury bond or note of a particular maturity.

Wall Street prepares for Treasuries mess as default looms

WBD Live in Miami - The Money Printing Debate with Jeff Snider and Lyn Alden — What Bitcoin Did

Solved Around $500 billion in U.S. Treasuries are traded

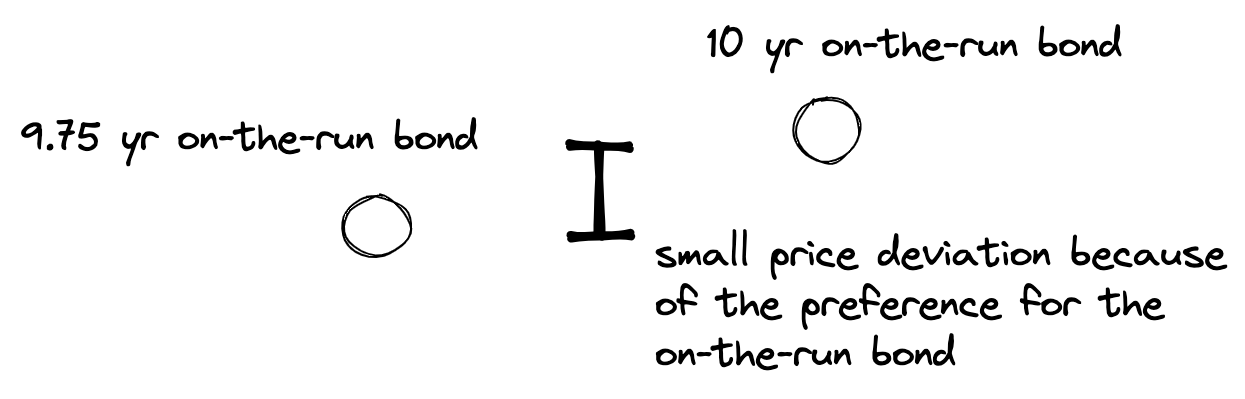

On the run Treasuries and off the run Treasuries - Guides - iSquare Intelligence

:max_bytes(150000):strip_icc()/GettyImages-1774251896-d9ed5cc6bb4d44eb93022e867c26fe39.jpg)

Investing in Treasury Bonds

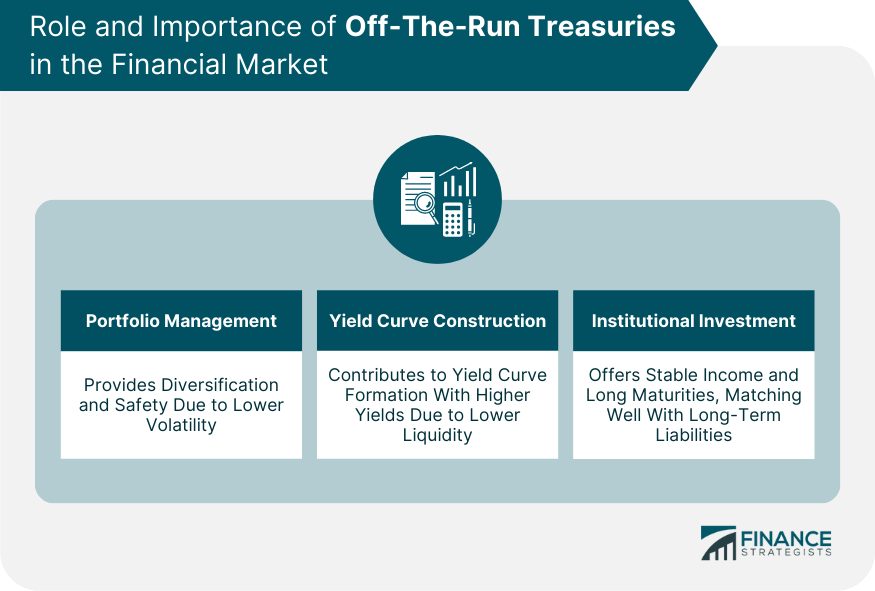

Off-The-Run Treasuries Definition, Types, Creation, Role

The Bond Market: How it Works, or How it Doesn't – Third Way

Fixed Income Trading: What It Is, Plus Interview & Career Guide

Off-The-Run Treasuries Definition, Types, Creation, Role

Understanding the “Inconvenience” of U.S. Treasury Bonds - Liberty Street Economics

Now that long TIPS yields are 60 bp off their highs I will… - Page 53

Solved Around $500 billion in U.S. Treasuries are traded

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)

Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the Difference?

What Are Treasury Bonds and How Do They Work? - TheStreet